17 Seconds #54 – A Publication For Clients And Other VIPs Of Clocktower Law.

Navigate Your Boat Where The Rocks Ain’t

A lobsterman based in Portland, Maine, was giving a guest a tour of Casco Bay, which is notoriously tricky to navigate. As the lobsterman navigated the boat to and fro, the guest was clearly getting antsy. “Man, you’re going fast,” said the guest nervously, “you must really know where all of the rocks are!” Without missing a beat, the lobsterman calmly replied, “Nope, know where they ain’t!”

“Knowing where they ain’t” is the key to drafting smart patent and trademark applications. Clocktower does a patent search before every patent filing and a trademark search before every trademark filing, because the key to successfully prosecuting both patents and trademarks is knowing where the prior art is (for patents) and prior trademarks are – and then avoiding them.

Clocktower launched in 2001, and since then, Clocktower has represented hundreds of startups, 22 of which have had successful exits. Notably, zero of those 22 startups had to rebrand due to trademark disputes, zero of those 22 startups had any patent disputes. So the value that Clocktower adds is not just in the POSITIVE OF THE POSITIVE, namely, the value of clients getting US and foreign patents and trademarks, it is also in the NEGATIVE OF THE NEGATIVE, namely, the value of clients NOT getting wrapped up in bad patent/trademark matters/disputes in the first place. As a result, our startup clients spend less on IP, more on product.

Clocktower knows where the rocks ain’t.

The Startup Life And Work-Life Balance

Is it merely a coincidence that Clocktower’s exits/lawyer/year ratio is as high as it is? I refuse to believe so. Clocktower’s attorneys have worked at, founded, cofounded, and mentored (including for Techstars and MassChallenge) many startups – as non-lawyers. We get startups because we live startups!

But the startup life is not for everyone. Not long after managing the firm through the 2001-2002 recession, I had to manage the firm through the Great Recession of 2008-2009. I never missed payroll, and I am proud of that, and I give employees about a 5% raise every year, regardless of the economy. Unfortunately, there are significant work-life balance challenges inherent in living the startup life.

From 2009-2012, for example, KAYAK was Clocktower’s second largest client. KAYAK filed for its IPO in 2010, IPOed in 2012, and was acquired in 2012. Shortly before the IPO, KAYAK replaced Clocktower with biglaw. I get it, you need biglaw to IPO (but not necessarily for IP, IMHO). But the reality is that representing startups like KAYAK during/after the Great Recession (a) contributed to the end of my first marriage (see “Notable Failures” in my LinkedIn profile) and (b) nearly sunk Clocktower. Note that “contributed to” is the operative phrase. In addition to losing KAYAK, we lost seven other startup clients to exits (about 50% of our total business) during that same time period. Yes, Clocktower got paid for all of the work that it did for KAYAK (on a 1099 basis and without equity) but so did all of its employees (on a W-2 basis and with ISOs). I now realize that this outcome was the responsibility – or blind spot – of BOTH parties. (For the record, I consider Paul English a friend, and we have discussed this issue privately. Paul never knew about these issues until this year, because I never told him. That’s on me. Many of Clocktower’s current clients came to us via referrals from Paul, and I am deeply indebted to him for Clocktower’s success.)

Accept The Inevitable, Act On What You Can Control

From 1997 to 2001, I worked for Verio, both in Boston and in Denver. Like KAYAK, Verio IPOed and got acquired. Over a period of four years, Verio acquired about 50 small Internet Service Providers (ISPs) and rolled them into one. Verio IPOed in 2000 and was acquired for $6 billion cash by NTT later that year. After the acquisition, employees in Verio’s Denver headquarters were talking about job security. One of them said to me, “NTT stated that we’re going to keep our offices, employees, and brands, so there’s nothing to worry about!” I replied, “Have you not been paying attention over the last four years? That’s what we told the 50 companies we acquired! Of course NTT will close offices, fire employees, and consolidate brands. It’s what Verio did! It’s inevitable!” I was the first employee to leave after the deal closed. Over the next two quarters, NTT fired over a third of Verio employees, closed offices, consolidated brands.

When your startup gets acquired, there will be winners, and there will be losers. You can’t control who the acquirer fires, just as you can’t control the inevitability of your own mortality (unless you are Neo in “The Matrix”). But you can have a better tomorrow by intentionally planning today. Do you have a trust and estates plan for the end of your life? You should also have a plan for the end of your startup.

So what is the blind spot? It is the risk-reward blind spot. Who takes more risk, the 1099 employee or the W-2 employee? Equity (which I foolishly never negotiated for with KAYAK in 2004) is supposed to be a REWARD FOR RISK taken. But if a large startup is relying on a small service provider – ANY service provider – in a significant way, then the startup should appropriately reward that service provider. What does “significant” mean in this context? If one client represents more than 10% of a small service provider’s business, then that is significant. Our insurance provider certainly asks every year whether a single client represents 10% or more of our business, and I strive to make that answer “no” every year!

There are many creative ways to solve the blind spot problem (including equity, success fees in lieu of equity, and/or bringing 1099 employees in-house at certain milestones), but my goal isn’t to dictate a solution, merely to shine light on the problem. As one key stakeholder told me months ago, “At the end of the day, entrepreneurs LOVE solving interesting problems with creative ideas.”

Whither Clocktower?

Today, Clocktower is all-in on startups. But if we had perfectly executed our old business plan – without reward for risk – then we would have gone out of business. Companies naturally want to grow. Clocktower is now at 5 FTEs. But for losing 22 startups to exits, Clocktower would be at 10 FTEs! To help companies grow, founders have to work ON THEIR STARTUPS not IN THEIR STARTUPS (to paraphrase the book “The E-Myth Revisited“). And to paraphrase a very smart person (although not Einstein), the definition of “insanity” is doing the same thing over and over and expecting different results. So Clocktower chose to pivot to a new business model that (a) captures the value Clocktower provides to startups (b) aligns incentives, and (c) eliminates the risk to Clocktower’s ability to offer that value on an ongoing basis.

Clocktower has embraced our role as a startup law firm, so now we must act like one. As such, Clocktower recently asked all clients to re-hire Clocktower on significantly revised terms (only slightly revised terms for nonprofits). Why? Because we want Clocktower to continue to be able to help startups succeed. But in order to do so, we had to fix the “bug” in Clocktower that was also its main “feature” – namely that we lost each time our clients won. The irony of the old way of doing business is that the success of Clocktower’s clients presented a material risk to us! So we needed to find a new way, to pivot, just like all startups must do.

The new “pivot” agreement does not dictate a solution. Rather, it provides a flexible framework for a path to a solution for all companies, big and small, for-profit and nonprofit. The agreement has been reviewed and vetted by clients, investors (angel and VC), ethics counsel, and other stakeholders.

Any good entrepreneur wants to ensure that when their tide rises, the boats around them rise too. But startup founders need to look more carefully at the boats – big and small – around them to see what impact they have as their startups grow and exit. FWIW, prospective clients are signing the new pivot agreement at three times the rate of the old agreement, so we think we have struck a good – and startup-friendly – balance between keeping IP affordable and rewarding for risk. The perfect prospective client for Clocktower? A two-person startup that has just signed on the dotted line with a top-tier accelerator such as Techstars.

Clocktower is now charting a new course, hoping that those clients who get it come along for the ride. These outcomes are good and acceptable: WIN-WIN, LOSE-LOSE. These outcomes are bad and unacceptable: WIN-LOSE, LOSE-WIN.

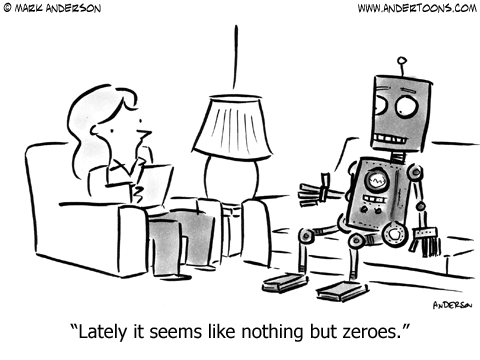

So, as “Mr. Robot” might ask, are you a one or a zero?

Or, as Adam Grant might ask, are you a giver or a taker?

Clocktower is all-in on startups, Clocktower is all in on WIN-WIN, Clocktower is a one, Clocktower is a giver. Are you?

17 Seconds is a publication for clients and other VIPs of Clocktower Law. Email version powered by MailChimp and the beat of a different keyboard player.